FAQs

As a member or member-to-be, you will find answers to our most frequently asked questions here.

Am I eligible to join MPECU?

You can see which employer groups MPECU currently serves by clicking here. If you don’t work at any of the businesses on the list, you can always join if you are the spouse, immediate family member of a current member, or a non-relative who lives with a current member. Also—if you own 5 shares of ALLETE stock you are also eligible to join (check your investment/retirement portfolio!)

How can I set up Direct Deposit or other deposits into my MPECU account?

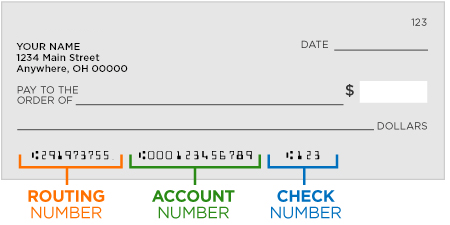

Your payroll department will need certain account information in order to set up direct deposit. They will need MPECU’s routing number and your account number. In some cases, they will also need a voided personal check from you. You can find information on depositing into your checking account at the bottom of your checks:

If you don’t have checks, or if you want to deposit into your savings account, please contact MPECU to get the correct information.

If you’d like your direct deposit to be split multiple ways once it arrives at MPECU, please call us at (866) 724-9339 to set up automatic transfers.

How can I change the PIN on my Debit or Credit Card?

For security reasons we are UNABLE to see or change the PIN number on your Mastercard Debit Card or Visa Credit Card.

Debit Card PIN Changes-You can change the PIN number by calling our vendor’s automated line at: (800) 717-4923.

Credit Card PIN Changes-You can change the PIN number by calling our vendor’s automated line at: (800) 290-7893.

What is the Daily Dollar Limit set on my debit card for a purchase? What about an ATM withdrawal?

Unless you’ve called us to temporarily or permanently change the limits, they are set at $1,000 per day for purchases and $315 per day for ATMs.

How can I reset my Online password?

If you are not locked out for too many wrong password attempts, and if you are able to answer your security questions, you can reset your Online Password yourself by clicking the “Forgot Password” link.

If you are locked out, you will need an MPECU employee to unlock your account. Reach us at 218-336-1800 or 866-724-9339 Monday – Friday from 8 am – 5 pm CST (excluding Federal Holidays).

How do I send money from MPECU to my account at another Financial Institution?

You can send money from your MPECU account to an account you own at another financial institution with an External Transfer in online banking. The initial setup process will take at least 2 business days. There is no fee for this service.

Sign into your online account. Click on the External Transfers link.

When the External Transfers page displays, click on Add Account. Fill in the information for the non-MPECU account and click Submit. The system will send a small test deposit to the external account within 1 – 2 business days. You MUST verify the amount of the test deposit to complete the enrollment process. Watch the non-MPECU account for the test deposit. Then log into your MPECU account again. Go to the External Transfers area once again and enter the amount of the test deposit. Once this is done, the accounts are linked. You can send and receive money between MPECU and your other account.

How can I send money to another person or business?

There are a few ways to do this:

- Wire Transfer

You can wire the money. In order to initiate a wire, you will need the wiring instructions for the financial institution receiving the money. Once you have the instructions, stop in or call us to start the wiring process. Wiring instructions must be received by 3:30 PM CST. There is a $15 wire fee for a domestic wire and a $50 wire fee for an international wire. Please note: the receiving institution may also have an incoming wire fee. It’s best to ask when you call for their wiring instructions. - Corporate Check

We can issue a corporate check from your account. Visit any of our 3 locations to pick up the check or call to have us mail it to you. There is no fee for this service. - Online Bill Pay

Our free bill pay service can be used to send money to a business, a friend, a landlord, etc. Payments can be sent out as a paper check, a direct deposit, or an email or text with an invitation for the receiving party to enter their own account information. Sign into Online, go to the Bill Pay tab, and read and accept the disclosures. At the far right is a link to “View demo” which will show you how to to set up different types of payees and payments. Click the Help link for written instructions for using Bill Pay. The Chat Now link will get you live online assistance with Bill Pay, even when MPECU is closed. - Transfer to Another MPECU Member

You can quickly transfer to another MPECU member in Online banking, if you know their member number. Click the Transfers tab, then transfer to Another Member.

I want to transfer to another member from within my online account. I have their account number, but what does "Transfer funds to ID” mean?

A Share ID is a 4 digit number which indicates which sub-account to put the money into. Common Share IDs:

0000-Membership Savings

0026-Star Tiered Savings

0030-Holiday Club

0060-Checking

Why are some of my Bill Payments made electronically and some with a paper check?

It depends on who you are sending money to. Whenever possible, our Bill Pay vendor sets up an electronic payment to pay your bill. Some recipients don’t accept electronic payments from a bill pay service. If our Bill Pay vendor isn’t aware of an established method to send the payment electronically, they will send a paper check instead.

I’m trying to view my e-statement but the screen states “Redirecting to E-statements” and isn’t going anywhere. Why?

Check your browser’s pop up blocker to allow pop ups. The E-statement window pops up in a separate screen. You should only have to accept pop ups once to avoid this problem in the future.

Do you offer Notary Services?

We do offer notary service at all three locations. You must have a current photo ID in order to have documents notarized.

Do you offer Medallion Stamp Services?

We offer Medallion Stamp Services up to $100,000 at the downtown offices. Please call ahead to ensure we can serve you.

Do I have Life Insurance through MPECU?

If you have signed up through our partner TruStage, you do have Life Insurance with your MPECU account. To verify, contact TruStage directly at (866) 277-9528 for questions and claims.